26+ Mortgage points break even

On a 200000 loan purchasing one point brings the mortgage rate from 41 to 385 dropping the monthly payment from 957 to 938 a monthly saving of 19. Cost of Points - The calculator assumes that 1 mortgage point costs 1 of the mortgage amount.

These Prices Are Straight Up Highway Robbery For Games That Printed Millions Of Carts 125 For Red Seems Like A Scam R Gameboy

This tool helps you determine whether paying paying additional charges for a specific interest rate or discount points in exchange for a lower interest rate is a good deal.

. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Compare Rates Get Your Quote Online Now. Up to 25 cash back But you can usually only deduct points paid on up to 750000 of mortgage debt 1000000 for mortgages originated before December 15 2017.

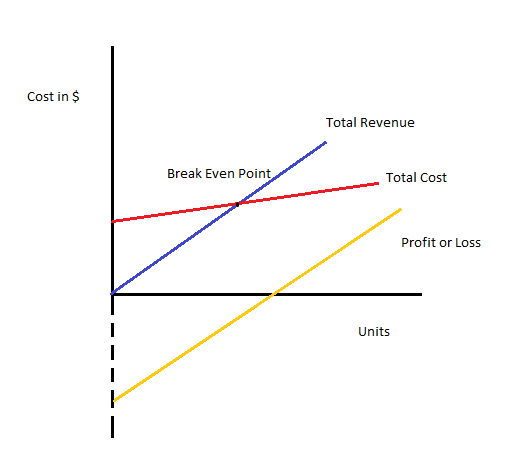

Mortgage Points Break Even Calculator to calculate when you can break even by buying discount points for your mortgage. The break-even point is when the savings from the lower interest rate match the cost of the points. If you also pay state andor local income taxes these marginal rates can be added to the Federal rate.

Great Lenders Reviewed By Nerdwallet. The simple calculation for breaking even on points is to take the cost of the points divided by the difference between monthly payments. Federal tax brackets currently are.

What is a break even point. The result is the amount of time it. With one mortgage point you will need to spend five years and nine months in your.

Review your mortgage points calculator results 1. This is calculated by dividing the cost of points by the monthly savings generated. The longer you expect.

The broker quoted above is referring to a case where a borrower who had previously agreed to pay 675 on a 30-year fixed-rate mortgage was offered 650 for an additional 15 points. Mortgage points are fees you pay upfront to reduce your mortgage interest rate and by extension your monthly payment amount. 10 15 25 28 33 and 35.

Fill out your loan terms before paying mortgage loan points First youll need to put your original loan terms into the mortgage points calculator. This process is also known as buying down. Ad Take Advantage Of Historically Low Mortgage Rates.

In this example the break-even point will be 69 months 2000 divided by 29 per month. So if points cost you 2000 and. Use our extensive real estate and mortgage terms glossary to get definitions that may pertain to you.

So 4000 divided by 6027 the amount youd save each month is about 66 which means the break-even point is about 66 monthsmeaning youd have to stay in the home for 66 months. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. If you dont stay in the mortgage beyond the break-even point youre losing money by.

Ad Americas 1 Online Lender. Compare Best Mortgage Lenders 2022. Determine The Break-Even Point To determine the break-even point you divide your closing costs by the amount you save every month.

Apply Online Get Pre-Approved Today.

The Riverdale Press 03 26 2020 By Richner Communications Inc Issuu

Esports In India Signal Vs Noise By Lumikai Medium

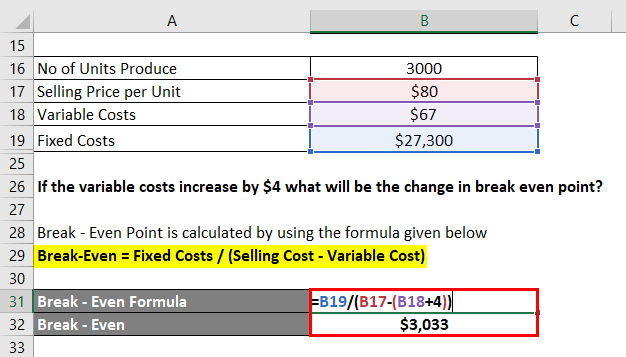

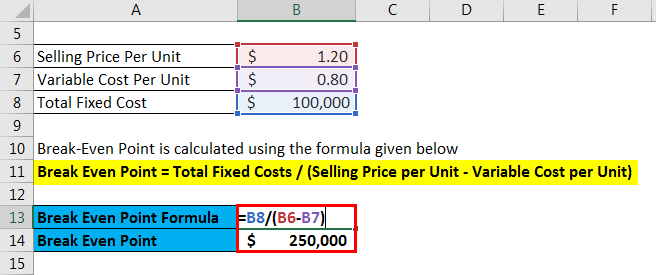

Break Even Analysis Formula Calculator Excel Template

Maybe You Should Just Lock On That Rate That Seems Disgustingly High R Firsttimehomebuyer

Break Even Analysis Formula Calculator Excel Template

Utah State Health Assessment

Esports In India Signal Vs Noise

Break Even Analysis Example Top 4 Examples Of Break Even Analysis

2022 Nascar Atlanta Folds Of Honor Quiktrip 500 Super Six Picks

Medical Device Manufacturing Businesses For Sale Buy Medical Device Manufacturing Businesses At Bizquest

Pdf Using Calculators In Mathematics 12 Student Text Gerald Rising Academia Edu

What Is The Something Borrowed Tradition All About That Many Brides Follow When Getting Married Quora

Break Even Analysis Formula Calculator Excel Template

Is There An Easy Explanation Of How To Find The Moments Of Forces About The Origin Quora

2

Break Even Analysis Formula Calculator Excel Template

Break Even Analysis Formula Calculator Excel Template